bna income tax planner user guide

Read the article below in order to calculate the total cost of ownership TCO which includes. BNA Income Tax Planner offers few flexible plans to their customers with the basic cost of a license starting from 1150 per year.

Bna Income Tax Planner Manualzz

Automate your fixed assets workflow so you can focus on your organizations strategic outlook.

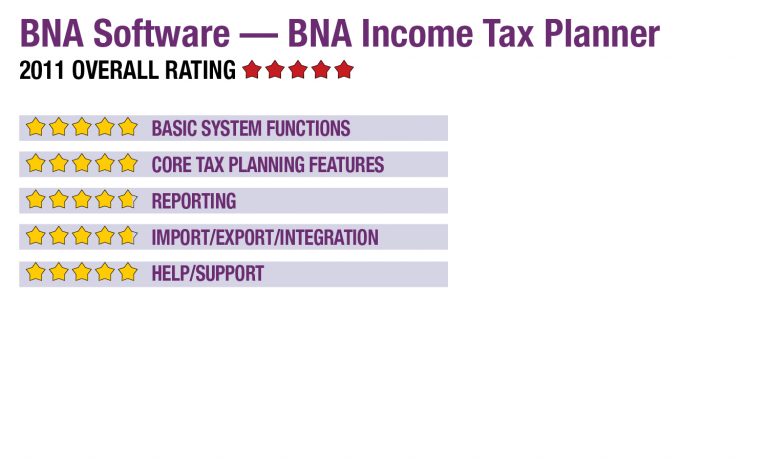

. BNA Income Tax Planner received a rating of 4 from ITQlick team. The BNA Income Tax Planner is designed to be a stand-alone tax planning system that integrates with a professionals existing tax preparation software. BNA Income Tax Planner is a leading cloud-based Business tax software it is designed to support small and medium size business.

You can leave your contact information with us to get a free custom quote. You can evaluate each and every adjustment you can make to your income deductions to claim and credits to take. Income Tax Planner gives you peace of mind as you strive to help clients grow and preserve wealth.

At the top of the nonpassive input screen within the activity you want is an entry for SEQualified income that will subject that income to SE tax and qbi theres a drop down below it to designate sstb vs nonsstb. Bna it web has a user guide made by Michael Cohen that isnt half bad. This corporate tax audit and planning software automates and manages complex multi-year corporate income tax attributes such as carrybacks and carryovers.

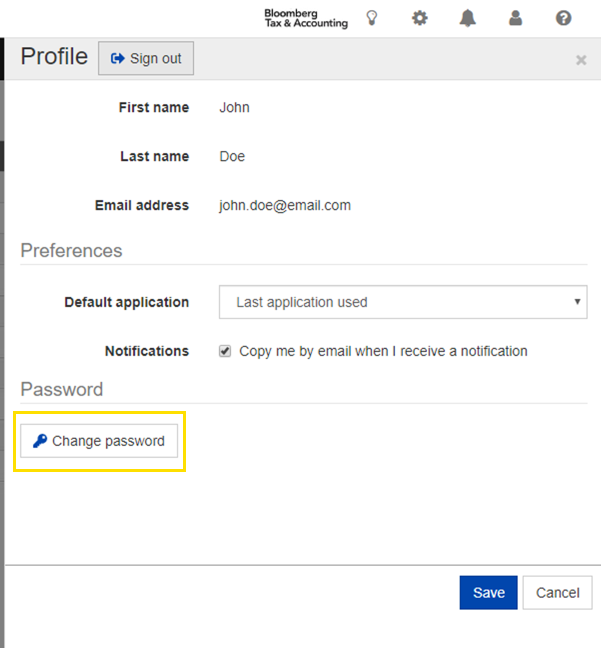

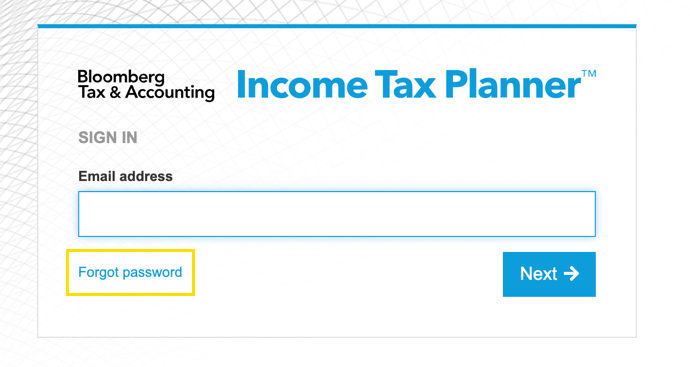

Starts at 1150 per year. Get the best results for your clients and grow your business. BNA has an online version of BNA Income Tax Planner.

Income Tax Planner gives you peace of mind as you strive to help clients grow and preserve wealth. Income Tax Planner opens. But before doing that make sure not to go too.

Customization data migration training hardware maintenance upgrades and more. State Tax Analyzer with NOL Manager Increase accuracy and precision with the latest calculations and projections for corporate tax planning audits and cash tax management. I dont have it up in front of me but from memory.

Create a worksheet and organize every major thing that needs to go into your income tax planner such as the income you earn adjustments deductions and credits. BNA Income Tax Planner allows users to calculate federal state and nonresident state income tax for capital gains estimated tax payments stock. With a wide range of powerful income tax planning and projection capabilities you can accurately provide your clients with the most comprehensive view of options to minimize their taxes.

The software cost is considered average 325 when compared to other solutions in their category. How to create my own income tax planner.

Answers To Frequently Asked Questions Income Tax Planner Help

Nonresident And Estimated Tax Software Video Youtube

Bna Income Tax Planner Quickstart Overview Youtube

Bna Income Tax Planner Pricing Vs Competitors Why Rated 6 4 10 Jul 2022 Itqlick

Bna Software Bna Income Tax Planner

Answers To Frequently Asked Questions Income Tax Planner Help